In the enchanting world of stock market investing, where the crystal ball of history often rhymes but never repeats, we find ourselves gazing at HealthEquity, Inc. (HQY), a company that has been making waves in the healthcare sector. Let’s dive into why this stock is currently flashing a buy signal.

A Beacon of Growth in the Healthcare Sector

HealthEquity operates in the niche market of health savings accounts (HSAs), a growing sector due to the rising costs of healthcare and the increasing popularity of high-deductible health plans. The company’s platform empowers individuals to make informed health savings and spending decisions, which is crucial in today’s complex healthcare landscape.

Financial Performance and Analyst Sentiment

A peek at HealthEquity’s financials reveals a robust picture. The company has consistently beaten earnings estimates, showcasing its ability to outperform expectations and manage its finances effectively. Analysts are taking note, with a consensus “Buy” rating and a favorable average price target that suggests a significant upside from the current price.

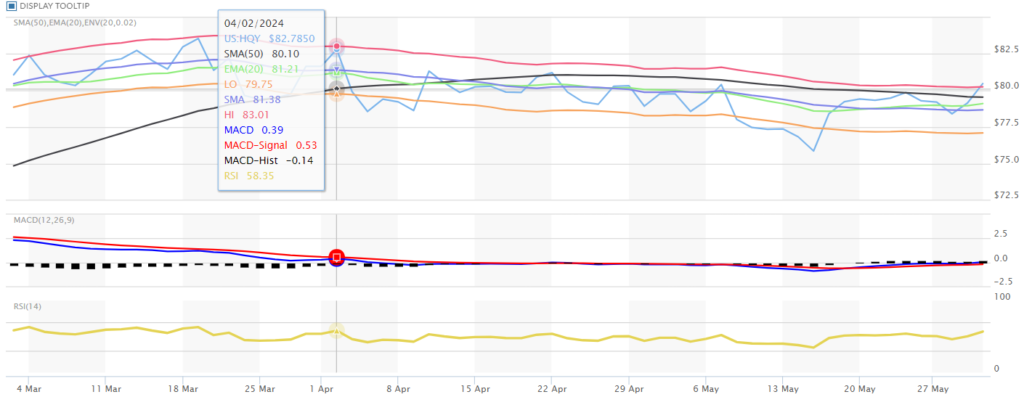

The Technical Indicators’ Tale

The technical analysis of HQY is like a siren’s song to investors, with trend, momentum, volatility, and volume indicators harmonizing to form a bullish chorus. The stock’s moving averages and MACD indicators suggest a positive momentum, while the Relative Strength Index (RSI) indicates that the stock is neither overbought nor oversold, providing a comfortable entry point for investors.

Strategic Acquisitions and Market Position

HealthEquity has recently made strategic acquisitions, including the BenefitWallet HSA portfolio, which added a substantial number of accounts and assets under management. This move not only expands the company’s market share but also demonstrates its commitment to growth and its ability to execute strategic initiatives successfully.

Innovation and Industry Trends

Innovation is the lifeblood of HealthEquity. The company is at the forefront of integrating technology into healthcare account management, offering a suite of solutions that cater to the evolving needs of consumers and employers. With the healthcare industry’s trend towards consumer-driven plans, HealthEquity is well-positioned to capitalize on this shift.

A Strong Business Model

HealthEquity’s business model is a fortress of strength, with recurring revenue streams from its HSA services. The company benefits from both the account management fees and the interest income generated from the custodial assets. This dual revenue stream provides stability and predictability to the company’s financials.

The Macro View

From a macroeconomic perspective, HealthEquity operates in an industry that is relatively insulated from economic downturns. Healthcare is a necessity, not a luxury, and as such, the demand for HealthEquity’s services is expected to remain robust regardless of the broader economic climate.

Institutional Confidence

Institutional investors have shown confidence in HealthEquity, with a high percentage of the company’s stock being held by institutional investors. This vote of confidence from the big players in the market is a reassuring sign for individual investors considering a position in HQY.

A Culture of Excellence

HealthEquity is not just about numbers; it’s about people. The company has been recognized for its workplace culture, which speaks volumes about its internal health and its ability to attract and retain top talent. A happy workforce often translates into exceptional service and innovation, which can drive the company’s success.

The Generative AI Factor

With the advent of generative AI, HealthEquity stands to benefit from increased productivity and innovation. The company’s investment in technology positions it to leverage AI advancements to enhance its services and maintain a competitive edge.

Conclusion

In the grand tapestry of the stock market, HealthEquity shines as a beacon of potential. Its strong financials, positive analyst sentiment, strategic growth initiatives, and robust business model all point to a stock that is ripe for investment. While the market’s moods are as fickle as the wind, the indicators suggest that now is an opportune time to consider HealthEquity as a buy. As always, investors should conduct their due diligence and consider their investment goals before making any decisions. But for those looking for a promising pick in the healthcare sector, HQY is certainly worth a closer look.