In the dynamic world of stock trading, identifying the right opportunities can make all the difference. Today, we’re focusing on Cullinan Management Inc. (CGEM), a stock that’s currently flashing a strong buy signal. Whether you’re a seasoned investor or just dipping your toes into the market, understanding why CGEM is a promising pick can help you make an informed decision. Let’s dive into the details and explore why CGEM is a stock worth considering right now.

1. Impressive Recent Performance

CGEM has been on a remarkable upward trajectory. Over the past week, the stock has surged by 10.68%, and over the past month, it has climbed by 22.94%. These significant gains indicate strong momentum and investor confidence, making it an attractive option for swing traders looking to capitalize on short-term movements.

2. Market Position and Sentiment

Currently priced at $20.31, CGEM is 165.8% above its 52-week low. This substantial increase from its low suggests that the stock has strong upward momentum and is gaining recognition in the market. Being well above its low also indicates that the stock has already demonstrated resilience and potential for further growth.

3. Technical Indicators Pointing Upwards

Several key technical indicators are signaling a bullish outlook for CGEM:

– RSI (Relative Strength Index): At 60.24, the RSI indicates that the stock is approaching overbought territory but still has room for upward movement. This suggests that there’s potential for further gains before hitting significant resistance.

– EMA (Exponential Moving Average): The latest EMA for CGEM is 18.9, which is below the current price, indicating a strong upward trend.

– MACD (Moving Average Convergence Divergence): With a MACD of 0.04, the stock shows a positive trend, suggesting that the momentum is in favor of buyers.

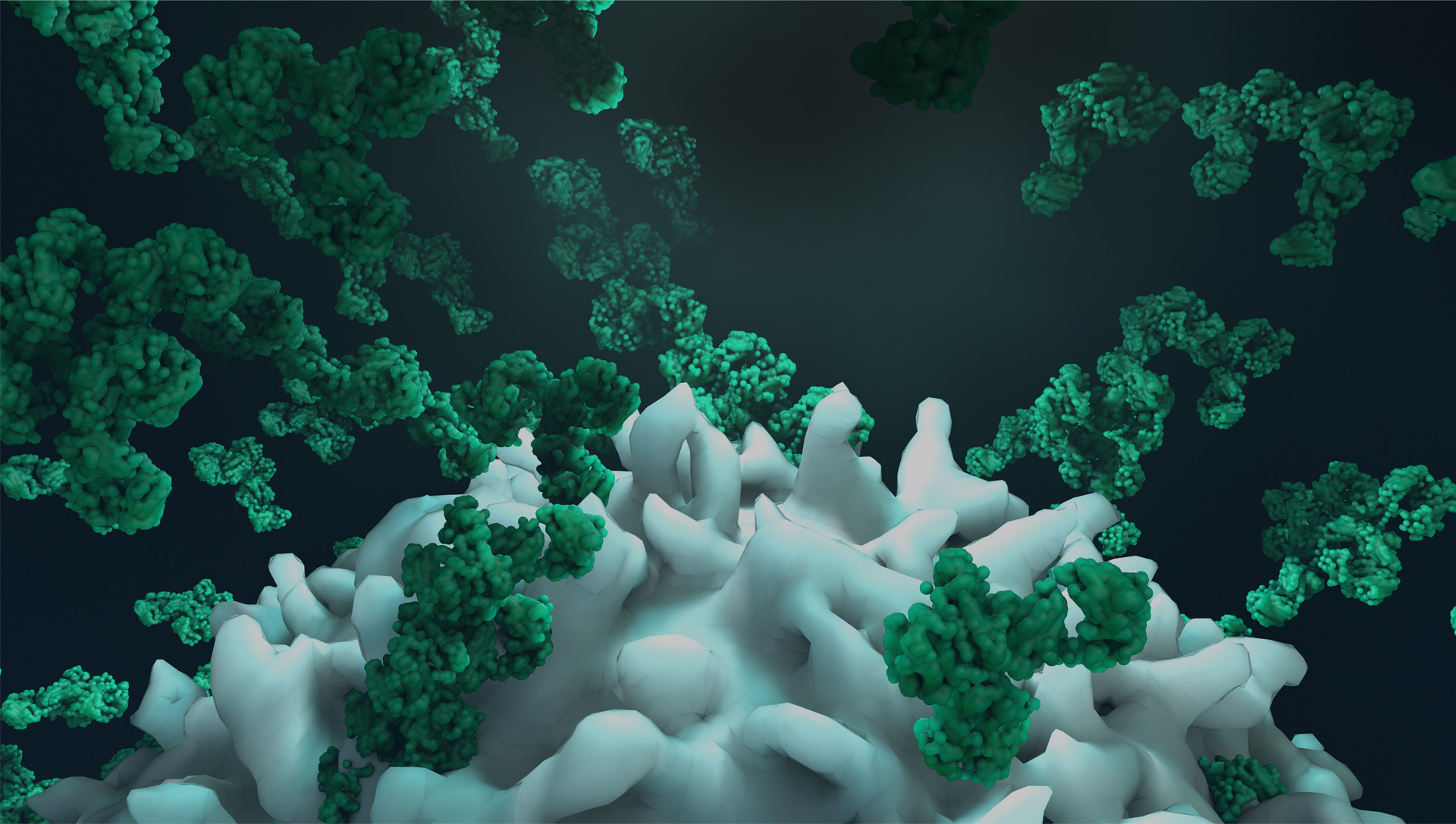

4. Strong Fundamental Backing

CGEM’s fundamentals also paint a promising picture. The company operates in the biopharmaceutical sector, focusing on developing innovative cancer therapies. This sector is known for its high growth potential, driven by ongoing advancements in medical research and increasing demand for effective treatments.

5. Institutional Confidence and Support

Institutional investors hold a significant portion of CGEM shares, indicating strong confidence in the company’s future. This backing from large investors often signals a positive outlook and can lead to increased stock price stability and growth.

6. Strategic Trailing Stop Percentage

Given CGEM’s recent performance and moderate volatility, a 12% trailing stop is recommended. This percentage allows for normal price fluctuations while protecting your investment from significant downside risk. A trailing stop helps you lock in profits if the stock price rises, ensuring that you benefit from upward movements while minimizing potential losses.

Conclusion

In conclusion, Cullinan Management Inc. (CGEM) presents a compelling buy signal for investors looking to capitalize on short-term gains. With its impressive recent performance, favorable technical indicators, and strong market positioning, CGEM is poised for growth. Implementing a 12% trailing stop will help you manage risk effectively while maximizing potential returns.

Investing in stocks always carries risks, but with careful analysis and strategic planning, you can make informed decisions that align with your financial goals. Happy trading!

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Always conduct your own research or consult a financial advisor before making any investment decisions.