In the ever-volatile world of stock trading, finding a gem that promises both stability and growth can feel like discovering a hidden treasure. One such gem currently making waves is Safe Bulkers Inc. (SB). If you’re a swing trader with a penchant for strong fundamentals and a tolerance for a bit of risk, SB might just be the stock to add to your portfolio. Here’s why Safe Bulkers is flashing a strong buy signal right now.

1. Robust Financial Health

Safe Bulkers has demonstrated impressive financial health, which is a cornerstone for any investment decision. The company boasts a profit margin of 27.9%, indicating that it is highly efficient at converting revenue into actual profit. This is significantly higher than many of its peers in the shipping industry, showcasing its operational efficiency and cost management prowess.

Moreover, SB’s operating margin stands at a robust 40.0%, further underscoring its ability to generate profit from its operations. This high operating margin is a testament to the company’s strong business model and effective management strategies.

2. Impressive Revenue Growth

Safe Bulkers has shown remarkable revenue growth, with a 22.2% increase in the most recent quarter. This growth is a clear indicator of the company’s expanding market presence and its ability to capitalize on favorable market conditions. For swing traders, this kind of growth is a positive signal, suggesting that the stock has the potential for upward momentum.

3. Attractive Valuation Metrics

When it comes to valuation, SB is trading at a forward P/E ratio of 7.42, which is relatively low compared to the industry average. This suggests that the stock is undervalued, providing a potential buying opportunity for investors. Additionally, the PEG ratio of 7.42 indicates that the stock is reasonably priced relative to its expected earnings growth, making it an attractive option for value-conscious investors.

4. Strong Technical Indicators

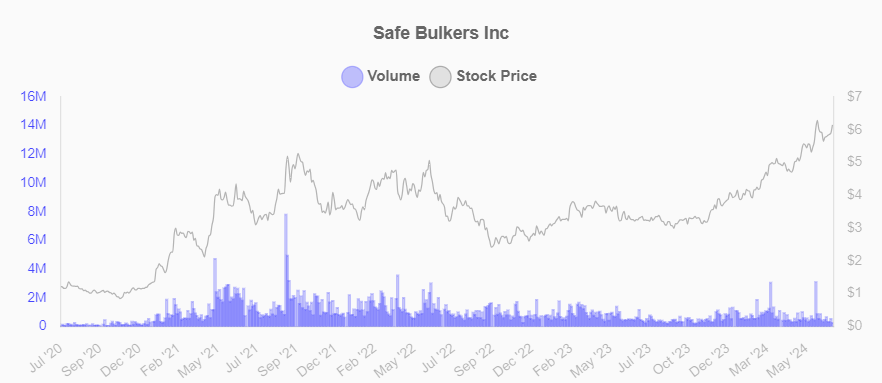

From a technical perspective, SB is showing promising signs. The stock has experienced a 46.6% increase year-to-date and a staggering 78.5% increase over the past year. These figures highlight the stock’s strong upward momentum, which is a key consideration for swing traders looking to capitalize on short

– to medium-term price movements.

The Relative Strength Index (RSI) for SB is currently at 53.56, which is in the neutral zone. This suggests that the stock is neither overbought nor oversold, providing a balanced entry point for potential investors.

5. Positive Market Sentiment

Market sentiment around Safe Bulkers is generally positive, driven by the company’s strong financial performance and growth prospects. The shipping industry has been experiencing a resurgence, and SB is well-positioned to benefit from this trend. With increasing demand for shipping services and favorable market conditions, SB is poised for continued growth.

6. Insider Confidence

Insider transactions can often provide valuable insights into a company’s future prospects. In the case of Safe Bulkers, there have been no significant insider sales, indicating confidence in the company’s future performance. This lack of insider selling is a positive signal for potential investors, suggesting that those closest to the company believe in its growth trajectory.

Conclusion: Setting Sail with Safe Bulkers

In conclusion, Safe Bulkers Inc. (SB) presents a compelling buy signal for swing traders. With its strong financial health, impressive revenue growth, attractive valuation metrics, and positive market sentiment, SB is well-positioned for continued success. The stock’s robust technical indicators and insider confidence further bolster its investment appeal.

As always, it’s important to conduct your own research and consider your risk tolerance before making any investment decisions. However, for those looking to navigate the choppy waters of the stock market, Safe Bulkers offers a promising vessel for potential profits. So, hoist the sails and set your course towards SB – it might just be the treasure you’ve been searching for.

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Always conduct your own research or consult a financial advisor before making any investment decisions.