In the ever-evolving world of stock investments, finding a company that combines strong fundamentals with promising growth potential can feel like discovering a hidden gem. Lantheus Holdings Inc. (LNTH) is one such gem that has been catching the eye of savvy investors. If you’re a swing investor comfortable with a bit of risk, LNTH might just be the buy signal you’ve been waiting for. Let’s dive into why this stock is worth your attention right now.

1. Robust Financial Performance

Lantheus Holdings has consistently demonstrated strong financial performance, which is a cornerstone for any solid investment. The company has shown impressive revenue growth, with the latest quarterly revenue reported at $369.98 million. This marks a significant increase from previous quarters, reflecting the company’s ability to expand its market presence and drive sales.

Moreover, LNTH’s net income for the most recent quarter stands at $131.07 million, showcasing its profitability. This consistent financial growth is a testament to the company’s effective management and strategic initiatives, making it a reliable choice for investors looking for stability and growth.

2. Attractive Valuation Metrics

Valuation is a critical factor when considering any stock investment. LNTH boasts a forward P/E ratio of 11.96 and a PEG ratio of 11.96, indicating that the stock is reasonably priced given its growth prospects. These metrics suggest that LNTH is not overvalued, providing a good entry point for investors.

Additionally, the company’s price-to-sales ratio of 4.04 further underscores its attractive valuation. This ratio, combined with the company’s strong revenue growth, suggests that LNTH is trading at a fair price relative to its sales, making it an appealing option for value-conscious investors.

3. Positive Technical Indicators

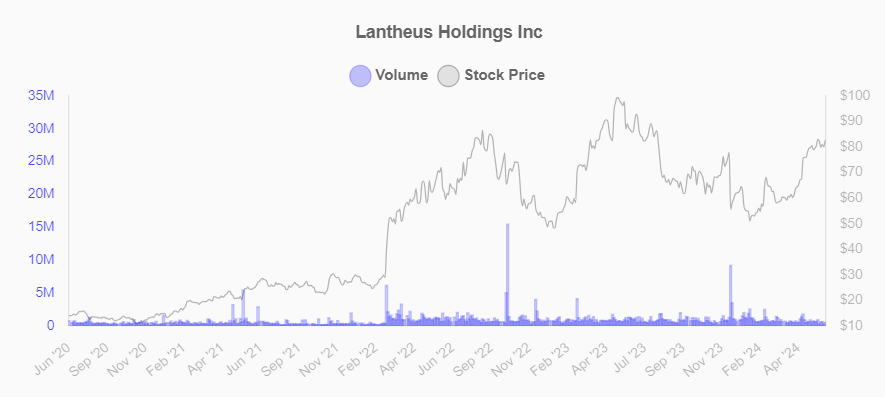

Technical analysis can provide valuable insights into a stock’s potential future performance. LNTH has shown strong momentum, with the stock up 31.1% year-to-date and 1.5% over the past month. This upward trend indicates growing investor confidence and suggests that the stock is gaining traction in the market.

Furthermore, LNTH’s RSI (Relative Strength Index) of 54.81 indicates that the stock is neither overbought nor oversold, providing a balanced entry point for new investors. The stock’s recent performance, combined with its technical indicators, points to a positive outlook in the near term.

4. Strong Market Position and Growth Potential

Lantheus Holdings operates in the healthcare sector, specifically in diagnostic imaging and therapeutic products. This sector is poised for growth, driven by an aging population and increasing demand for advanced medical diagnostics. LNTH’s innovative product portfolio and strategic partnerships position it well to capitalize on these market trends.

The company’s recent achievements, such as gaining regulatory approvals and expanding its product offerings, further enhance its growth potential. These developments not only strengthen LNTH’s market position but also provide a solid foundation for future revenue and profit growth.

Conclusion: A Compelling Buy Signal

In summary, Lantheus Holdings Inc. (LNTH) presents a compelling buy signal for swing investors looking for a blend of strong fundamentals, attractive valuation, and positive technical indicators. The company’s robust financial performance, reasonable valuation metrics, and promising growth potential make it a standout choice in the healthcare sector.

As always, it’s essential to conduct your own research and consider your risk tolerance before making any investment decisions. However, if you’re looking for a stock with solid growth prospects and a track record of financial success, LNTH might just be the hidden gem ready to shine in your portfolio.

Disclaimer: This blog entry is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making any investment decisions