Hello, fellow investors! Today, let’s dive into why Full Truck Alliance (YMM) is presenting a compelling buy opportunity. With a mix of strong fundamentals, positive market sentiment, and promising growth prospects, YMM is a stock worth considering for your portfolio.

1. Impressive Financial Performance: Full Truck Alliance has shown robust financial growth. In the most recent quarter, the company reported revenue of $312.83 million, up from $284.33 million in the previous quarter. This consistent revenue growth highlights the company’s ability to scale its operations effectively. Additionally, YMM’s net income has been positive, with the latest figure at $80.14 million, indicating strong profitability.

2. Strong Earnings Growth: YMM has consistently beaten earnings expectations. The latest EPS was $0.0138, surpassing the estimate of $0.0097. This trend of outperforming earnings estimates is a positive indicator of the company’s financial health and management’s ability to deliver results.

3. Positive Market Sentiment: Recent news articles have highlighted YMM as a promising investment, particularly in the context of a potential rebound in the Chinese economy. For instance, a recent article titled “3 Chinese Penny Stocks to Buy for the China Rebound” (June 16,2024) specifically mentioned YMM as a top pick. This positive media coverage can boost investor confidence and drive stock price appreciation.

4. Attractive Valuation: Despite its strong performance, YMM remains attractively valued. The stock’s trailing P/E ratio is 30.27, and its forward P/E ratio is 14.41, suggesting that the market has not fully priced in its growth potential. Additionally, YMM’s price-to-sales ratio of 1.05 indicates that the stock is reasonably priced relative to its revenue.

5. Growth Potential in the Logistics Sector: Full Truck Alliance operates in the logistics and transportation sector, which has significant growth potential, especially in China. As the largest digital freight platform in China, YMM is well-positioned to capitalize on the increasing demand for efficient logistics solutions. The company’s platform connects shippers with truckers, optimizing the transportation process and reducing costs, which is a valuable proposition in a rapidly growing economy.

6. Strong Institutional Support: Institutional investors hold a significant stake in YMM, with 54.9% of the shares held by institutions. This high level of institutional ownership indicates confidence in the company’s long-term prospects and can provide stability to the stock price.

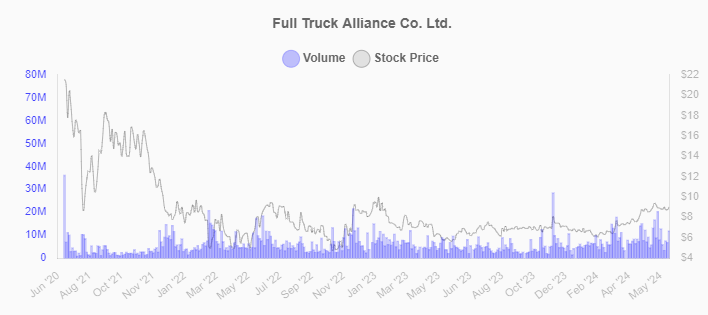

7. Technical Indicators: From a technical perspective, YMM’s stock has been showing positive momentum. The current price of $8.99 is up 32.6% year-to-date and 31.7% over the past year. The stock’s RSI (Relative Strength Index) of 59.13 suggests that it is not overbought, leaving room for further upside. Additionally, the stock is trading close to its 52-week high, indicating strong investor interest.

8. Strategic Initiatives and Expansion: Full Truck Alliance is continuously innovating and expanding its services. The company has been investing in technology to enhance its platform’s capabilities, including AI-driven logistics solutions. These strategic initiatives are expected to drive further growth and improve operational efficiency.

In conclusion, Full Truck Alliance (YMM) presents a strong buy opportunity right now. With its impressive financial performance, positive market sentiment, attractive valuation, and significant growth potential in the logistics sector, YMM is well-positioned for future success. Adding YMM to your portfolio could be a smart move to capitalize on the company’s growth trajectory and the broader rebound in the Chinese economy. Happy investing!

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Always conduct your own research or consult with a financial advisor before making investment decisions.