Hello, fellow investors! Today, I want to share some exciting insights about ACM Research Inc. (ACMR) and why it might be a great buy signal right now. Whether you’re a seasoned investor or just starting, ACMR offers a compelling case for your portfolio. Let’s dive into the details!

1. Impressive Financial Performance

One of the first things that stand out about ACMR is its strong financial performance. The company has shown remarkable growth, with a quarterly earnings growth year-over-year (YoY) of 144%. This kind of growth is not something you see every day and indicates that ACMR is on a solid upward trajectory. Additionally, the company boasts a profit margin of 13.8%, which is quite healthy and suggests efficient management and operations.

2. Attractive Valuation Metrics

Valuation is a critical factor when considering any stock, and ACMR shines in this area. The forward price-to-earnings (P/E) ratio of 12.06 suggests that the stock is potentially undervalued compared to its earnings prospects. This low P/E ratio indicates that investors are not yet fully appreciating the company’s growth potential, providing an opportunity for those who get in early.

3. Strong Revenue Growth

ACMR’s revenue growth is another compelling reason to consider this stock. The company has reported a quarterly revenue growth of 105%, which is impressive by any standard. This significant increase in revenue shows that ACMR is expanding its market presence and successfully scaling its operations. For investors, this means the company is likely to continue generating higher revenues, which could translate into higher stock prices.

4. Positive Technical Indicators

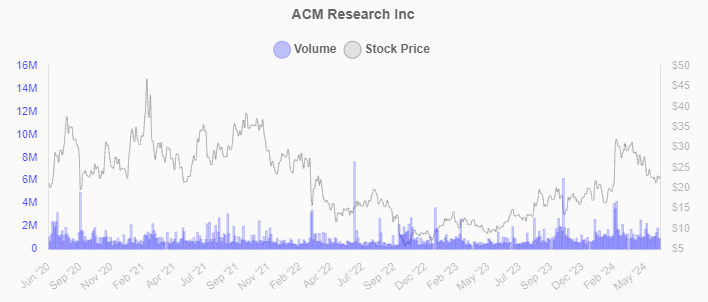

From a technical analysis perspective, ACMR also looks promising. The current price of $25.68 is significantly above its 52-week low of $9.36, indicating strong upward momentum. While the stock is trading below its 52-week high of $34.40, this could be seen as a buying opportunity, especially given the company’s strong fundamentals. The stock’s beta of 1.41 suggests it is more volatile than the market, which can be attractive for swing investors looking for significant price movements.

5. Institutional and Insider Confidence

It’s always reassuring to see that those closest to the company have confidence in its future. ACMR has 17.5% of its shares held by insiders and 59.3% held by institutions. This high level of insider and institutional ownership indicates that those with the most knowledge about the company believe in its long-term prospects.

6. Market Position and Future Potential

ACMR operates in the semiconductor equipment industry, which is poised for growth as demand for semiconductors continues to rise. The company’s innovative solutions and strong market position make it well-placed to capitalize on this trend. As technology advances and the need for more sophisticated semiconductor equipment grows, ACMR is likely to benefit significantly.

Conclusion

In summary, ACMR presents a compelling buy signal today due to its impressive financial performance, attractive valuation, strong revenue growth, positive technical indicators, and high insider and institutional confidence. While no investment is without risk, ACMR’s potential for growth makes it a stock worth considering for your portfolio.

Happy investing, and may your portfolio be ever in your favor!

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Always conduct your own research or consult with a financial advisor before making investment decisions.