Hello, fellow investors! Today, let’s set sail and explore why Navios Maritime Partners LP (NMM) might be a promising addition to your portfolio. Whether you’re a seasoned trader or just dipping your toes into the investment waters, recognizing potential opportunities is key. Let’s dive into why NMM could be a compelling buy signal today.

Navios Maritime Partners LP (NMM): Navigating Strong Currents Navios Maritime Partners LP (NMM) is a leading international owner and operator of dry cargo vessels. With a market capitalization of $1.26 billion, NMM has been making waves in the maritime industry. Here are some key reasons why NMM might be a good buy signal today.

1. Robust Financial Performance:

– Revenue Growth: NMM has demonstrated solid revenue growth, with a trailing twelve-month (TTM) revenue of $1.31 billion. Despite a slight quarterly revenue decline of 11.8% year-over-year, the company’s ability to generate substantial revenue remains strong.

– Profitability: The company boasts a profit margin of 33.2% and an operating margin of 31.3%. These figures highlight NMM’s efficiency in managing its operations and turning revenue into profit.

– Earnings Growth: NMM’s quarterly earnings growth year-over-year stands at 12.0%, showcasing the company’s robust financial health and potential for future growth.

2. Attractive Valuation:

– Price-to-Earnings Ratio: NMM’s trailing P/E ratio of 2.97 and forward P/E ratio of 2.80 suggest that the stock is significantly undervalued compared to its peers. This makes it an attractive option for value investors looking for a bargain.

– Price-to-Sales Ratio: With a price-to-sales ratio of 0.966, NMM is trading at a reasonable valuation relative to its revenue, indicating potential for price appreciation.

3. Solid Balance Sheet:

– Low Debt Levels: NMM has a total debt of $2.13 billion and a total debt-to-equity ratio of 76.96. While the debt level is relatively high, the company’s strong cash flow generation helps mitigate this risk.

– Strong Cash Position: The company holds $287.38 million in cash, providing it with the liquidity needed to fund operations and invest in growth opportunities.

4. Positive Technical Indicators:

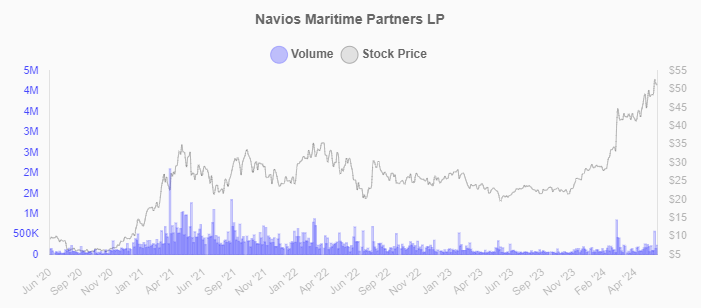

– Price Momentum: NMM’s current price of $50.53 is significantly above its 52-week low of $19.23, reflecting strong upward momentum. The stock is also trading above its 200-day moving average of $27.76, indicating a bullish trend.

– Relative Strength Index (RSI): The latest RSI of 46.16 suggests that the stock is not overbought, leaving room for further price appreciation.

5. Market Sentiment:

– Institutional Support: With 25.2% of shares held by institutions, NMM has strong backing from institutional investors. This level of support often indicates confidence in the company’s long-term prospects.

Conclusion Navios Maritime Partners LP (NMM) presents a compelling buy signal today, thanks to its robust financial performance, attractive valuation, solid balance sheet, positive technical indicators, and strong market sentiment. The company’s impressive profit margins and earnings growth, coupled with its strong cash position, make it a promising investment opportunity in the maritime sector.

As always, it’s essential to conduct your own research and consider your investment goals and risk tolerance before making any decisions. Happy investing, and may your portfolio sail smoothly towards profits!

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Always conduct your own research or consult with a financial advisor before making investment decisions.