Hello, fellow investors! Today, let’s explore why VAALCO Energy Inc. (EGY) might be a shining star in your portfolio. Whether you’re a seasoned trader or just getting started, it’s essential to recognize potential opportunities. Let’s dive into why EGY could be a compelling buy signal today.

VAALCO Energy Inc. (EGY): A Hidden Gem in the Energy Sector VAALCO Energy Inc. (EGY) is an independent energy company engaged in the exploration, development, and production of crude oil and natural gas. With a market capitalization of $620.74 million, EGY has been making waves in the energy sector. Here are some key reasons why EGY might be a good buy signal today.

1. Strong Financial Performance:

– Revenue Growth: EGY has shown impressive revenue growth, with a quarterly revenue growth year-over-year of 24.6%. This indicates the company’s ability to generate increasing sales, a positive sign for potential investors.

– Profitability: The company boasts a profit margin of 13.6% and an operating margin of 32.6%. These figures highlight EGY’s efficiency in managing its operations and turning revenue into profit.

– Earnings Growth: EGY’s quarterly earnings growth year-over-year stands at 121.5%, showcasing the company’s robust financial health and potential for future growth.

2. Attractive Valuation:

– Price-to-Earnings Ratio: EGY’s trailing P/E ratio of 10.00 and forward P/E ratio of 6.06 suggest that the stock is undervalued compared to its peers. This makes it an attractive option for value investors looking for a bargain.

– Price-to-Sales Ratio: With a price-to-sales ratio of 1.31, EGY is trading at a reasonable valuation relative to its revenue, indicating potential for price appreciation.

3. Solid Balance Sheet:

– Low Debt Levels: EGY has a total debt of $90.24 million and a total debt-to-equity ratio of 19.10. This low level of debt relative to equity suggests that the company is not overly leveraged, reducing financial risk.

– Strong Cash Position: The company holds $113.32 million in cash, providing it with the liquidity needed to fund operations and invest in growth opportunities.

4. Positive Technical Indicators:

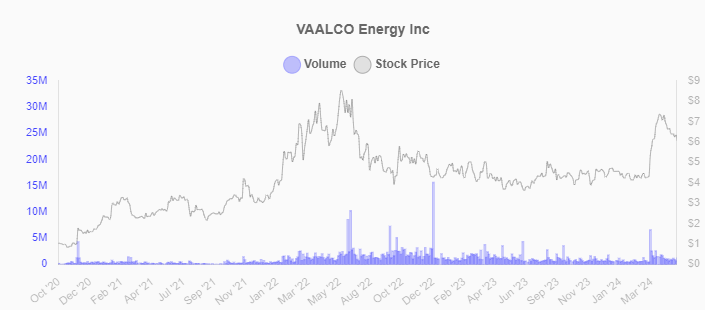

– Price Momentum: EGY’s current price of $6.48 is significantly above its 52-week low of $3.55, reflecting strong upward momentum. The stock is also trading above its 200-day moving average of $4.92, indicating a bullish trend.

– Relative Strength Index (RSI): The latest RSI of 39.38 suggests that the stock is not overbought, leaving room for further price appreciation.

5. Market Sentiment:

– Institutional Support: With 58.0% of shares held by institutions, EGY has strong backing from institutional investors. This level of support often indicates confidence in the company’s long-term prospects.

Conclusion VAALCO Energy Inc. (EGY) presents a compelling buy signal today, thanks to its strong financial performance, attractive valuation, solid balance sheet, positive technical indicators, and robust market sentiment. The company’s impressive revenue and earnings growth, coupled with its low debt levels and strong cash position, make it a promising investment opportunity in the energy sector.

As always, it’s essential to conduct your own research and consider your investment goals and risk tolerance before making any decisions. Happy investing, and may your portfolio be ever prosperous!

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Always conduct your own research or consult with a financial advisor before making investment decisions.