Hello, fellow investors! Today, I want to shine a spotlight on a stock that has been making waves in the e-commerce world: Pinduoduo Inc. (PDD). If you’re looking for a promising investment with strong growth potential, PDD might just be the perfect addition to your portfolio. Let’s dive into why PDD is flashing a strong buy signal today.

Impressive Financial Performance

Pinduoduo has been consistently delivering impressive financial results. The company has a market capitalization of $199.25 billion and an enterprise value of $77.25 billion, indicating its significant presence in the market. One of the standout metrics is its trailing price-to-earnings (PE) ratio of 18.68 and a forward PE ratio of 9.00, suggesting that the stock is undervalued relative to its future earnings potential.

Moreover, PDD’s revenue growth has been nothing short of spectacular. In the most recent quarter, the company reported revenues of $11.99 billion, up from $9.51 billion in the previous quarter. This kind of growth is indicative of a company that is rapidly expanding its market share and capturing more consumer dollars. For an e-commerce platform, this is particularly important as it shows that their value proposition is resonating with customers.

Strong Profitability Metrics

Pinduoduo’s profitability metrics are also impressive. The company boasts a profit margin of 26.9% and an operating margin of 29.9%, which are both healthy figures for an e-commerce company. These margins indicate that PDD is managing its costs effectively while still delivering value to its customers. Additionally, the company’s quarterly earnings growth year-over-year stands at a staggering 245.6%, further underscoring its strong financial performance.

Robust Cash Flow and Low Debt

Another key factor that makes PDD an attractive buy is its robust cash flow and low debt levels. The company has a total cash position of $33.41 billion and a total debt of only $1.31 billion, resulting in a very low debt-to-equity ratio of 4.33. This strong cash position provides PDD with the financial flexibility to invest in growth opportunities and weather any potential economic downturns.

Positive Technical Indicators

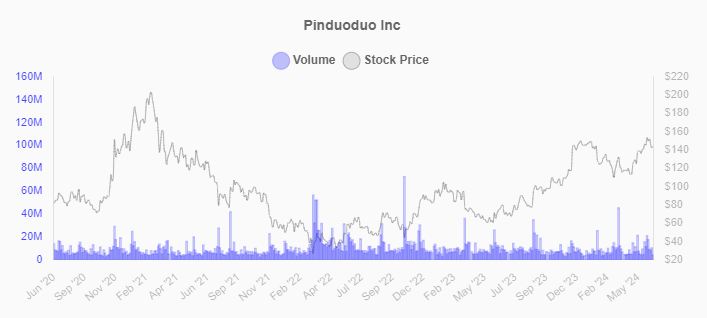

From a technical perspective, PDD is also showing strong buy signals. The current price of $148.09 is near its 52-week high of $164.69, indicating strong upward momentum. The stock is trading above its 50-day moving average of $132.17 and its 200-day moving average of $123.22. These moving averages are important technical indicators that suggest the stock is in a bullish trend.

The Relative Strength Index (RSI) for PDD is at 58.41, which is in the positive momentum territory but not yet overbought. This means there is still room for the stock to grow before it hits overbought levels, making it an opportune time to buy.

Recent Performance and Market Position

Looking at recent performance, PDD has shown resilience and growth. Over the past year, the stock has gained 95.4%, and it is up 3.2% year-to-date. The company’s quarterly revenue growth of 130.7% and quarterly earnings growth of 245.6% year-over-year are particularly encouraging.

Pinduoduo’s market position is also worth noting. As one of the leading e-commerce platforms in China, PDD is well-positioned to benefit from the continued growth of online shopping in the region. The company’s innovative approach to social commerce, which leverages group buying and social sharing, has resonated with consumers and driven its rapid growth.

Conclusion

In conclusion, Pinduoduo Inc. (PDD) presents a compelling buy signal today. With impressive financial performance, strong profitability metrics, robust cash flow, low debt levels, and positive technical indicators, PDD is well-positioned for continued growth. If you’re looking for a stock with a solid foundation and significant upside potential, PDD is definitely worth considering.

Happy investing!

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Please conduct your own research or consult with a financial advisor before making any investment decisions.