Hello, fellow investors! Today, I want to talk about a stock that has been catching my eye lately: Ollie’s Bargain Outlet Holdings Inc. (OLLI). If you’re a swing investor like me, who appreciates strong fundamentals and isn’t afraid of a bit of risk, OLLI might just be the perfect addition to your portfolio. Let’s dive into why OLLI is flashing a strong buy signal today.

Strong Fundamentals

First and foremost, Ollie’s Bargain Outlet has been demonstrating robust fundamentals. The company has consistently beaten its earnings per share (EPS) estimates, which is always a good sign. For instance, in the most recent quarter, OLLI reported an EPS of 1.23, significantly higher than the estimated 1.16. This consistent outperformance indicates that the company is not only meeting but exceeding market expectations, which is a positive indicator for future growth.

Moreover, OLLI’s revenue growth has been impressive. The latest quarter saw revenues of $648.95 million, up from $480.05 million in the previous quarter. This kind of growth is indicative of a company that is expanding its market presence and capturing more consumer dollars. For a retailer, this is particularly important as it shows that their value proposition is resonating with customers.

Attractive Valuation

When it comes to valuation, OLLI is looking quite attractive. The stock has a trailing price-to-earnings (PE) ratio of 25.50 and a forward PE ratio of 21.03. These figures suggest that the stock is reasonably priced, especially when you consider its growth prospects. Additionally, the price-to-sales ratio stands at 2.17, which is fair for a company with such strong revenue growth.

Another key metric to consider is the company’s profit margin, which is currently at 8.6%. This is a healthy margin for a retailer and indicates that OLLI is managing its costs effectively while still delivering value to its customers. The operating margin of 15.0% further underscores the company’s efficiency and profitability.

Positive Technical Indicators

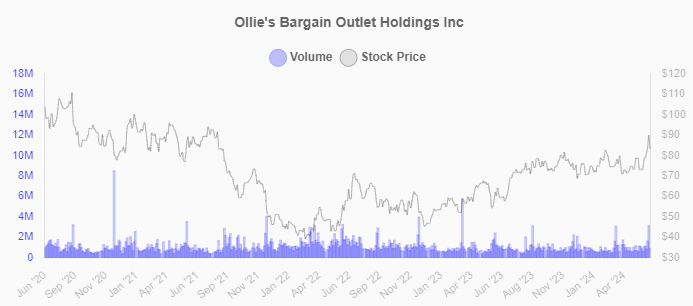

From a technical perspective, OLLI is also showing strong buy signals. The current price of $84.56 is near its 52-week high of $84.38, indicating strong upward momentum. The stock is trading above its 50-day moving average of $75.67 and its 200-day moving average of $74.76. These moving averages are important technical indicators that suggest the stock is in a bullish trend.

The Relative Strength Index (RSI) for OLLI is at 61.93, which is in the positive momentum territory but not yet overbought. This means there is still room for the stock to grow before it hits overbought levels, making it an opportune time to buy.

Recent Performance and Insider Activity

Looking at recent performance, OLLI has shown resilience and growth. Over the past year, the stock has gained 8.8%, and while it is down 4.1% year-to-date, this dip could be seen as a buying opportunity. The company’s quarterly revenue growth of 18.0% and quarterly earnings growth of 44.1% year-over-year are particularly encouraging.

It’s also worth noting that insider activity can provide insights into the company’s prospects. Recently, there was an insider sale by President Eric van der Valk, which might raise some eyebrows. However, this should be viewed in the context of the overall positive momentum and strong fundamentals of the company.

Conclusion

In conclusion, Ollie’s Bargain Outlet Holdings Inc. (OLLI) presents a compelling buy signal today. With strong fundamentals, attractive valuation, positive technical indicators, and solid recent performance, OLLI is well-positioned for growth. If you’re a swing investor looking for a stock with a solid foundation and the potential for significant upside, OLLI is definitely worth considering.

Happy investing!

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Please conduct your own research or consult with a financial advisor before making any investment decisions.