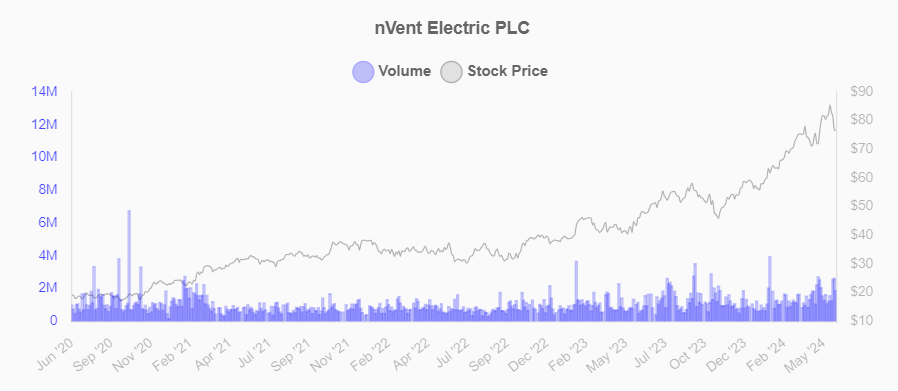

Hello, fellow investors! If you’ve been keeping an eye on n Vent Electric PLC (NVT), you might be wondering whether now is the right time to make a move. As a friendly guide through the ups and downs of the market, I’m here to share why today might be the perfect time to consider buying NVT.

Recent Price Movements

– Current Price: $77.79

– 52-Week Range: $43.21 – $86.57

NVT is currently trading at $77.79, which is 80% above its 52-week low of $43.21. This indicates a strong recovery from its lows, suggesting that the stock has gained significant positive momentum. Although it is still 10.1% below its 52-week high of $86.57, this presents a potential buying opportunity for investors looking to capitalize on its upward trend.

Technical Indicators

– RSI: 67.12

– MACD: 0.19

The Relative Strength Index (RSI) of 67.12 suggests that the stock is approaching overbought territory but still has room to grow. The MACD of 0.19 indicates bullish momentum, which could drive the stock price higher in the short term. These technical indicators suggest that NVT has the potential for further gains.

Recent Performance

– 1-Week Change: -0.2%

– 1-Month Change: +11.0%

– Year-to-Date Change: +42.1%

NVT has shown a positive trend over the past month, with a gain of 11.0%. Although the stock experienced a slight dip of 0.2% over the past week, its year-to-date performance of +42.1% indicates strong overall growth. For investors looking for a stock with potential for continued appreciation, NVT could be an attractive option.

Fundamentals

– Market Cap: $13.83B

– Trailing PE: 24.28

– Forward PE: 23.33

– Profit Margin: 17.0%

– Operating Margin: 18.4%

NVT’s trailing PE ratio of 24.28 and forward PE ratio of 23.33 indicate that the stock is relatively undervalued compared to its peers. This suggests that there might be room for price appreciation as the company continues to grow. Additionally, NVT has a profit margin of 17.0% and an operating margin of 18.4%, which are impressive and indicate strong profitability.

Recent News and Financials

– Q 12024 Financial Outcomes: The recent financial report showed a net income of $254.9M and revenue of $861.2M. These figures highlight the company’s strong financial performance and growth potential.

NVT’s quarterly revenue growth of 18.1% and quarterly earnings growth of 12.0% year-over-year are impressive and indicate that the company is on a strong growth trajectory. This positive financial performance could drive further stock price appreciation.

Insider and Institutional Holdings

– Percent Held by Insiders: 1.0%

– Percent Held by Institutions: 93.5%

The high percentage of institutional holdings suggests that large investors have confidence in the company’s future prospects. This can be a positive sign for retail investors looking to follow the lead of institutional investors.

Conclusion

Given the recent price movements, technical indicators, and strong financial performance, today might be a good time to consider buying NVT. The stock has shown signs of recovery and growth, and the current market conditions suggest that it might continue to appreciate in value. Remember, every investment decision should be based on your individual financial situation and risk tolerance. Always do your own research or consult with a financial advisor before making any moves.

Happy investing, and may your portfolio always be in the green!

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Please conduct your own research or consult with a financial advisor before making any investment decisions.