Hello, fellow investors! If you’ve been keeping an eye on Bit Digital, Inc. (BTBT), you might be wondering whether now is the right time to make a move. As a friendly guide through the ups and downs of the market, I’m here to share why today might be the perfect time to consider buying BTBT.

Recent Price Movements

– Current Price: $2.68

– 52-Week Range: $1.76 – $5.27

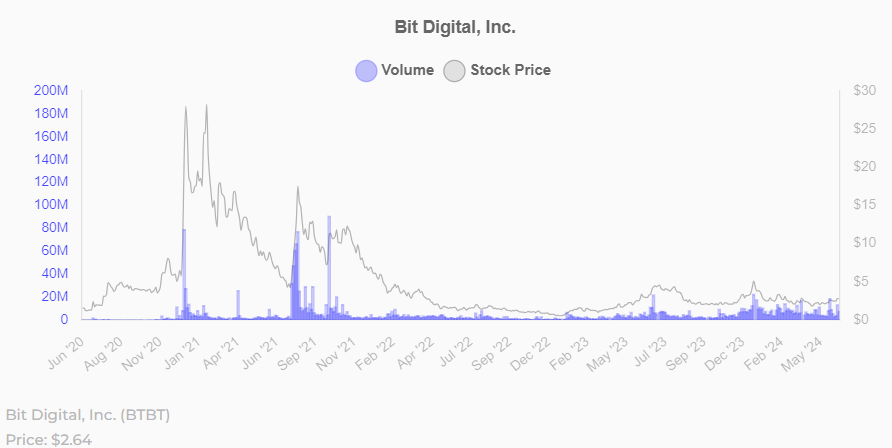

BTBT is currently trading at $2.68, which is 52.6% above its 52-week low of $1.76. This indicates a strong recovery from its lows, suggesting that the stock has gained some positive momentum. Although it is still 49.1% below its 52-week high of $5.27, this presents a potential buying opportunity for investors looking to capitalize on its upward trend.

Technical Indicators

– RSI: 58.01

– MACD: 0.08

The Relative Strength Index (RSI) of 58.01 suggests that the stock is approaching overbought territory but still has room to grow. The MACD of 0.08 indicates bullish momentum, which could drive the stock price higher in the short term. These technical indicators suggest that BTBT has the potential for further gains.

Recent Performance

– 1-Week Change: +2.8%

– 1-Month Change: +15.6%

– Year-to-Date Change: -46.4%

BTBT has shown a positive trend over the past week and month, with gains of 2.8% and 15.6%, respectively. Although the stock is down 46.4% year-to-date, the recent upward momentum suggests that it might be on the path to recovery. For investors looking for a stock with potential for a rebound, BTBT could be an attractive option.

Fundamentals

– Market Cap: $300.09M

– Trailing PE: 8.27

– Forward PE: 10.78

BTBT’s trailing PE ratio of 8.27 and forward PE ratio of 10.78 indicate that the stock is relatively undervalued compared to its peers. This suggests that there might be room for price appreciation as the company continues to grow. Additionally, BTBT has a profit margin of 57.4%, which is impressive and indicates strong profitability.

Recent News and Financials

– Q 12024 Financial Outcomes: The recent financial report showed a net income of $50.08M and revenue of $30.29M. These figures highlight the company’s strong financial performance and growth potential.

BTBT’s quarterly revenue growth of 266.5% and quarterly earnings growth of 266.5% year-over-year are impressive and indicate that the company is on a strong growth trajectory. This positive financial performance could drive further stock price appreciation.

Insider and Institutional Holdings

– Percent Held by Insiders: 0.8%

– Percent Held by Institutions: 41.2%

While the percentage held by insiders is relatively low, the high percentage of institutional holdings suggests that large investors have confidence in the company’s future prospects. This can be a positive sign for retail investors looking to follow the lead of institutional investors.

Conclusion

Given the recent price movements, technical indicators, and strong financial performance, today might be a good time to consider buying BTBT. The stock has shown signs of recovery and growth, and the current market conditions suggest that it might continue to appreciate in value. Remember, every investment decision should be based on your individual financial situation and risk tolerance. Always do your own research or consult with a financial advisor before making any moves.

Happy investing, and may your portfolio always be in the green!

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Please conduct your own research or consult with a financial advisor before making any investment decisions.