In the dynamic world of investing, identifying opportunities that align with growth potential is essential for investors seeking to maximize returns. Today, we turn our attention to Aer Cap Holdings NV (AER) and explore why it stands out as a strong buy signal in the current market landscape. Let’s delve into the factors that make AER an attractive investment choice and why now might be the perfect time to consider adding it to your portfolio.

1. Strong Financial Performance:

AER’s robust financial performance sets a solid foundation for its growth prospects. With a market capitalization of $17.31 billion and an enterprise value of $61.82 billion, AER’s financial stability and market positioning are noteworthy. The company’s trailing price-to-earnings ratio of 6.20 and forward price-to-earnings ratio of 7.92 indicate an undervalued stock with potential for future growth. AER’s profit margin of 41.4% and operating margin of 53.1% reflect operational efficiency and profitability, making it an attractive choice for investors seeking a strong financial profile.

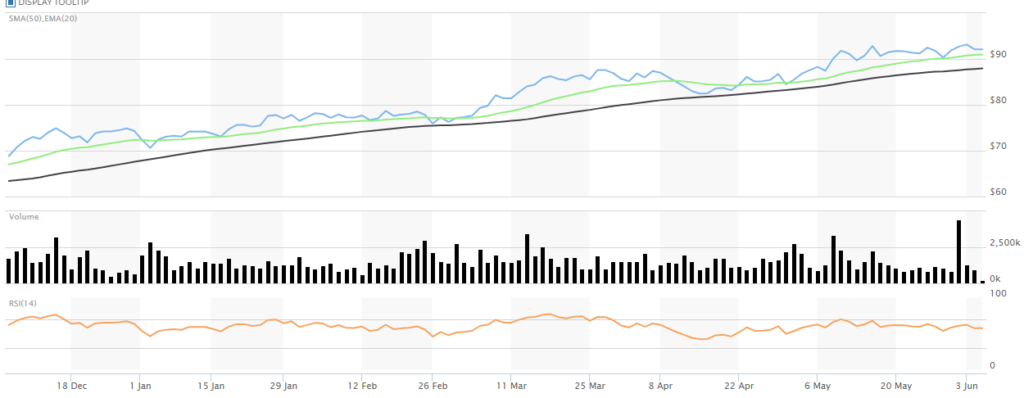

2. Positive Market Indicators:

AER’s recent price movements and key technical indicators suggest a favorable outlook for the stock. Trading at $92.26, AER is positioned closer to its 52-week high of $88.44 than its low of $53.42, indicating positive momentum. The stock’s beta of 1.85 indicates higher volatility compared to the market, offering opportunities for traders seeking short-term gains. AER’s recent price percentage changes of 0.1% in the past day, 0.4% in the past month, and 15.8% year-to-date signal positive market sentiment and investor interest in the stock.

3. Growth Potential and Strategic Positioning:

AER’s focus on the aviation industry and aircraft leasing positions it well in a sector poised for growth. As the global economy recovers and air travel demand rebounds, AER is well-positioned to benefit from increased leasing activity and airline partnerships. The company’s strong quarterly revenue growth of 5.4% and quarterly earnings growth year-over-year of 123.4% underscore its growth potential and ability to capitalize on market opportunities. With a diverse portfolio of aircraft and a strong presence in the aviation leasing market, AER presents a compelling investment opportunity for those looking to tap into the aviation industry’s resurgence.

4. Investor Confidence and Institutional Support:

AER’s strong fundamentals and growth prospects have garnered investor confidence, with 96.8% of the stock held by institutions. Institutional support often signals a positive outlook for a stock, as professional investors recognize its potential for long-term growth. Additionally, AER’s total cash of $1.76 billion and operating cash flow of $5.26 billion provide a solid financial foundation for future investments and strategic initiatives, further bolstering investor confidence in the company’s stability and growth trajectory.

In conclusion, Aer Cap Holdings NV (AER) emerges as a compelling buy signal today, backed by its strong financial performance, positive market indicators, growth potential, and investor confidence. With a solid financial profile, positive market sentiment, and strategic positioning in a growing industry, AER presents an attractive investment opportunity for those looking to capitalize on the aviation sector’s recovery and long-term growth prospects.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Always conduct your own research or consult a financial advisor before making any investment decisions.