Altimmune Inc (ALT) is currently positioned as an intriguing buy signal in the market, offering investors a promising opportunity for potential growth and value. Let’s delve into the reasons why ALT stands out as a compelling investment choice at this moment.

1. Strong Market Position:

ALT has established itself as a key player in the biotech industry, focusing on developing innovative immunotherapeutic products. With a market capitalization of $531.06 million, ALT’s presence in the market signifies its potential for growth and impact.

2. Positive Price Movements:

ALT has experienced significant price movements, with a 268.4% increase from its 52-week low, showcasing a strong upward trend. This positive momentum indicates growing investor interest and confidence in the company’s future prospects.

3. Financial Stability:

Despite recent challenges, ALT has maintained a solid financial position with a total cash of $182.02 million, providing a cushion for future investments and operations. Additionally, ALT’s enterprise value of $351.0 million suggests a favorable valuation in the market.

4. Growth Potential:

ALT’s quarterly revenue growth of -76.2% may seem concerning at first glance, but it also presents an opportunity for potential turnaround and improvement. The company’s focus on developing cutting-edge products could lead to revenue growth in the future.

5. Insider and Institutional Holdings:

With 0.8% held by insiders and 63.3% held by institutions, ALT’s strong backing from key stakeholders indicates confidence in the company’s long-term prospects. This level of support can be a positive sign for investors considering a buy position.

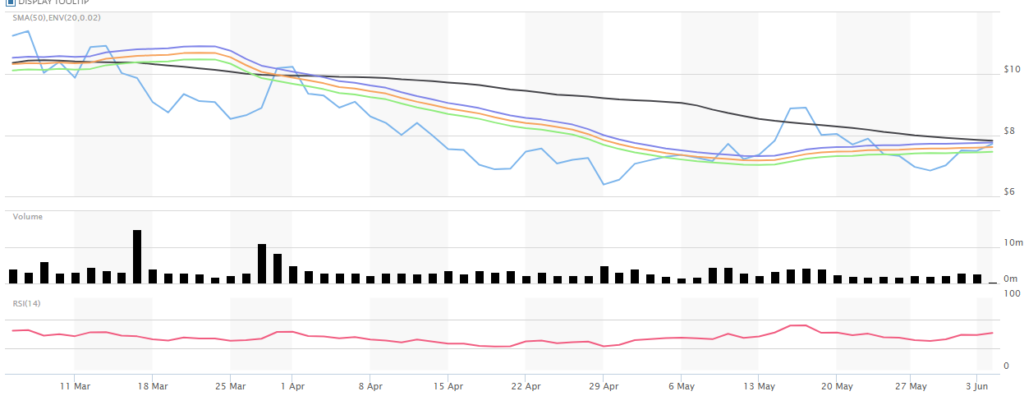

6. Technical Analysis:

ALT’s technical indicators, such as the Relative Strength Index (RSI) at 51.89, suggest a neutral stance, providing a balanced view for potential investors. The stock’s recent price movements and indicators like the Moving Average Convergence Divergence (MACD) can offer insights into the stock’s momentum.

7. Market Sentiment:

ALT’s current price is 48.1% below its 52-week high, indicating a potential opportunity for growth and recovery. The stock’s recent performance, including a 11.4% increase in the past week, suggests positive market sentiment and investor interest.

In conclusion, ALT’s strong market position, positive price movements, financial stability, growth potential, insider and institutional holdings, technical analysis, and market sentiment collectively point towards a buy signal for investors looking for a promising opportunity in the biotech sector. As always, it’s essential for investors to conduct thorough research and consider their risk tolerance before making any investment decision