In the world of investing, finding the right opportunities can feel like discovering hidden treasures. Today, we’re setting our sights on Duke Energy Corp (DUK) and why it’s shining brightly as a buy signal in the current market landscape.

Steady Performance Amidst Volatility

DUK has been a beacon of stability in the energy sector, weathering market storms with resilience. Its consistent revenue growth and strong fundamentals have positioned it as a reliable choice for investors seeking a balance of growth and stability.

Robust Fundamentals

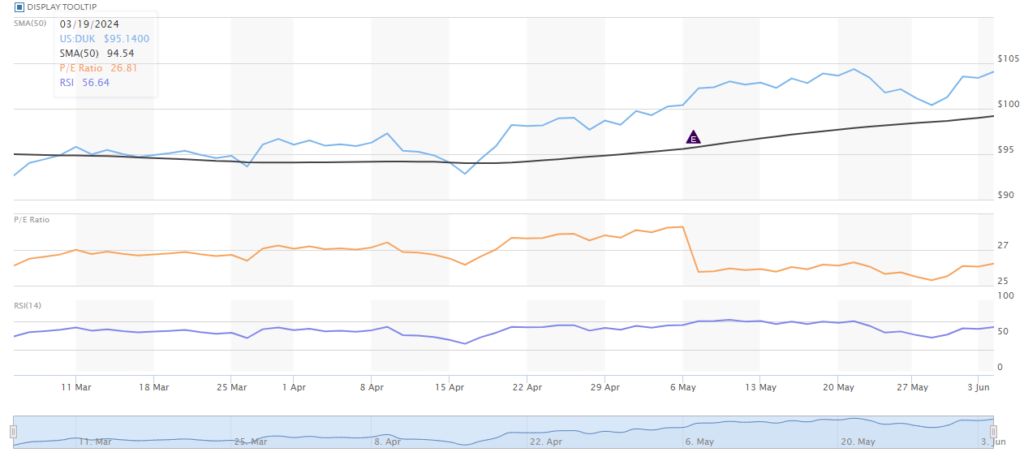

When it comes to evaluating a potential investment, fundamentals play a crucial role. DUK boasts a healthy profit margin of 10.9% and an operating margin of 25.4%, showcasing its efficiency in generating profits. With a trailing P/E ratio of 18.50 and a forward P/E ratio of 16.34, DUK presents an attractive valuation proposition.

Strategic Positioning for Growth

Duke Energy Corp has strategically positioned itself for future growth, evident in its quarterly revenue growth of 5.4% and a quarterly earnings growth year-over-year of 41.5%. These figures underscore the company’s ability to adapt and thrive in changing market conditions.

Financial Health and Stability

A key aspect of any investment decision is the financial health of the company. DUK’s strong balance sheet, with a market capitalization of 79.83B and a net income of 4.31B, instills confidence in its ability to navigate challenges and capitalize on opportunities.

Commitment to Sustainability

In an era where sustainability is paramount, DUK stands out for its commitment to environmental responsibility. The company’s focus on renewable energy initiatives and reducing its carbon footprint aligns with the growing global emphasis on sustainability, making it an attractive choice for socially conscious investors.

Market Outlook and Potential

Looking ahead, DUK’s strategic initiatives, solid financial performance, and commitment to sustainability position it favorably for future growth. As the energy sector continues to evolve, DUK’s forward-thinking approach sets it apart as a promising investment opportunity.

In Conclusion

Duke Energy Corp (DUK) shines as a beacon of stability, growth, and sustainability in the energy sector. With robust fundamentals, strategic positioning, and a commitment to environmental responsibility, DUK presents a compelling buy signal for investors looking for a reliable and forward-looking investment opportunity.

As always, it’s essential to conduct thorough research and consider your investment goals and risk tolerance before making any investment decisions. With DUK, the future looks bright, offering investors a chance to ride the wave of growth and stability in the energy sector.