In the enchanting world of stock trading, where the brave dare to tread, ARM Holdings emerges as a beacon for the bullish. Why, you ask? Let’s embark on a journey through the financial landscape to uncover the compelling reasons why ARM is flashing a buy signal that’s hard to ignore.

A Symphony of Analysts’ Acclaim

First, let’s tune into the chorus of analysts singing praises for ARM. The harmony of bullish sentiment is impossible to overlook. With a robust “Buy” consensus and a crescendo of positive outlooks, ARM is like a virtuoso poised to deliver a stellar performance. The maestros at Rosenblatt have even set a price target of $180, a testament to their confidence in ARM’s crescendoing market value.

The AI Overture

The crescendo builds with ARM’s strategic pivot towards artificial intelligence (AI). As AI weaves its way into the fabric of technology, ARM’s AI-optimized chip designs and software tools are like the first notes of a grand overture, promising to transform smartphones and beyond. This forward-thinking move positions ARM at the forefront of a burgeoning AI market, ready to conduct an orchestra of devices powered by its technology.

A License to Thrive

ARM’s business model is a masterpiece of recurring revenue. By licensing its chip designs, ARM has crafted a symphony of steady income streams. Each new device containing its technology is a note that adds to the melody of royalties, and with the transition to v9 architecture, these royalties could double. It’s like a recurring refrain that grows richer with every rendition.

The Momentum of Mobile and Beyond

The mobile market, where ARM’s technology is a maestro, continues to expand. But ARM isn’t content to rest on its laurels. It’s extending its reach into servers, data centers, and IoT devices, conducting an ever-expanding ensemble of technology. With each new market, ARM’s potential for growth multiplies, like a theme that develops into a grander musical work.

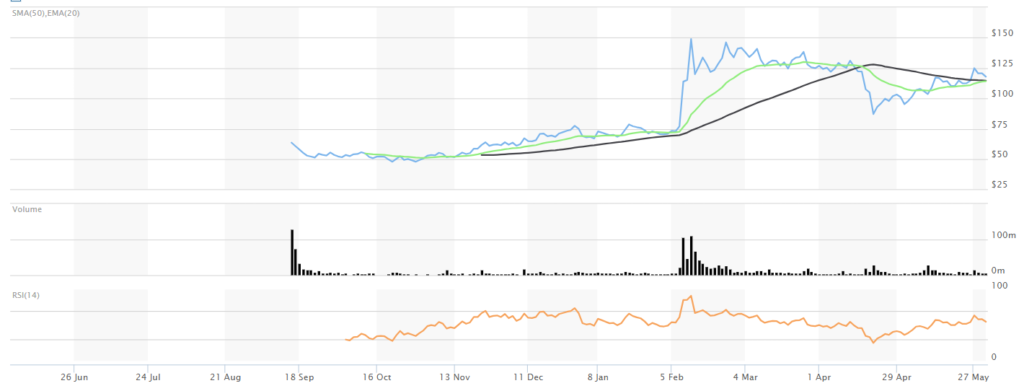

A Stock in the Spotlight

Let’s not forget the stock’s performance itself. ARM’s shares have surged, trading higher and capturing the market’s attention. This movement isn’t just a fleeting trill; it’s a sustained note that resonates with the market’s rhythm. The stock’s recent pullback, despite strong quarterly results, is like a brief intermission before the next act—a prime opportunity for investors to take their seats.

The Conductor of Connectivity

ARM’s technology is the conductor of a digital revolution, orchestrating a symphony of connectivity. With its designs enabling intelligent computing in billions of chips, ARM’s influence extends across the globe. The company’s commitment to innovation ensures that its technology remains at the cutting edge, like a conductor who continually brings new ideas to the stage.

A Crescendo of Catalysts

The crescendo of catalysts for ARM is impossible to ignore. From its bullish analyst ratings to its strategic AI initiatives and expanding market reach, ARM is a stock that’s hitting all the right notes. For the active trader who thrives on fundamentals and isn’t shy of risk, ARM presents an opportunity that’s as exciting as it is sound.

Encore!

In conclusion, ARM Holdings is not just a stock; it’s a symphony of potential. With a strong fundamental score, a strategic pivot towards AI, and a licensing model that promises recurring revenue, ARM is a buy signal that beckons the bold. So, dear investors, if you’re ready to compose your own financial success, consider ARM as the note that starts your next great investment melody. The stage is set, the audience is waiting, and the time to act is now. Let the music play!