Hello, dear readers! Today, we’re diving into the fascinating world of LanzaTech Global (LNZA), a company that’s been making waves in the waste management and carbon recycling industry. If you’re on the hunt for a stock that’s ripe for the picking, LNZA might just be the treasure you’re looking for. Let’s explore why this small-cap gem is a good buy right now.

Innovative Technology with a Green Twist

LanzaTech is not your average company. It stands out with its cutting-edge technology that transforms waste carbon into valuable chemical building blocks. This isn’t just good for business; it’s a boon for the planet too. By reusing carbon, LanzaTech is helping to keep our skies and oceans cleaner, aligning perfectly with the growing global demand for sustainable practices.

Analyst Confidence and Upside Potential

When the experts speak, we listen. And the analysts are singing LanzaTech’s praises. With a Buy rating from Roth MKM’s Leo Mariani, who boasts an impressive 89% accuracy rate, and a projected 94% upside, it’s clear that those in the know see a bright future for LNZA. This level of confidence from top analysts is a strong indicator that LanzaTech is on the right track.

Financial Health and Growth Prospects

LanzaTech’s financials are robust, with a cash runway of approximately 14 months and a forecast to break even in about two years. The company’s revenue has been growing steadily, and it’s expected to continue outpacing the industry average. With no debt on the books, LanzaTech presents a reduced investment risk, making it an attractive option for those who like to play it a bit safer.

Market Position and Shareholder Composition

Retail investors hold a significant 30% stake in LanzaTech, which means individual investors like you and me have a substantial influence over the company. This level of public investment is a testament to the company’s appeal to the market. Moreover, with institutional investors and insiders also holding stakes, there’s a sense of credibility and alignment of interests that’s reassuring for potential investors.

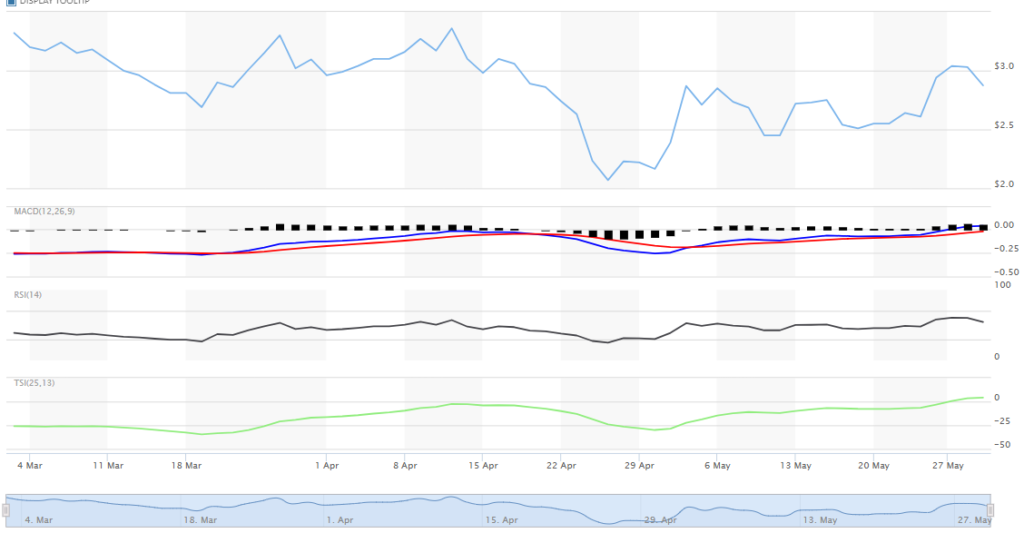

Recent Performance and Price Movements

While LanzaTech’s share price has seen some volatility, the company’s high price-to-sales ratio suggests that the market expects continued growth. This is a company that’s not just surviving but thriving, with a 68% gain in revenue last year and a forecast for continued expansion. For those who can weather the ups and downs, LanzaTech offers the potential for significant rewards.

The Path to Profitability

Analysts are optimistic about LanzaTech’s path to profitability, expecting the company to turn a profit by 2026. With anticipated growth of 73% year-on-year, LanzaTech is on a fast track to financial success. And let’s not forget, with no debt, the company is in a strong position to capitalize on its growth without the burden of financial constraints.

A Company with a Conscience

In today’s world, it’s not enough to just make money; companies need to do good too. LanzaTech is a shining example of a business that’s committed to creating a sustainable future. Its technology is not only innovative but also environmentally friendly, turning pollution into products. This commitment to sustainability has earned LanzaTech a spot on TIME’s Inaugural TIME100 Climate List, further solidifying its reputation as a company with a conscience.

The Bottom Line

LanzaTech Global is a company that ticks all the right boxes. It’s at the forefront of sustainable technology, it’s financially healthy, and it’s got the backing of savvy analysts. With a clear path to profitability and a strong market position, LanzaTech is a stock that’s poised for growth. For the active trader who’s not afraid of a little risk, LNZA presents an opportunity that’s hard to pass up. So, if you’re looking to add a touch of green to your portfolio and potentially reap the rewards of a forward-thinking investment, LanzaTech Global might just be the perfect fit. Happy investing!