Hello, my fellow market mavens! Today, let’s chat about a gem that’s been catching some glints of light in the financial markets – Aura Biosciences, Inc. (NASDAQ: AURA). Now, I know you savvy traders are always on the hunt for the next big thing, and I’ve got some compelling reasons why Aura might just be a sparkling addition to your portfolio.

A Technical Triumph

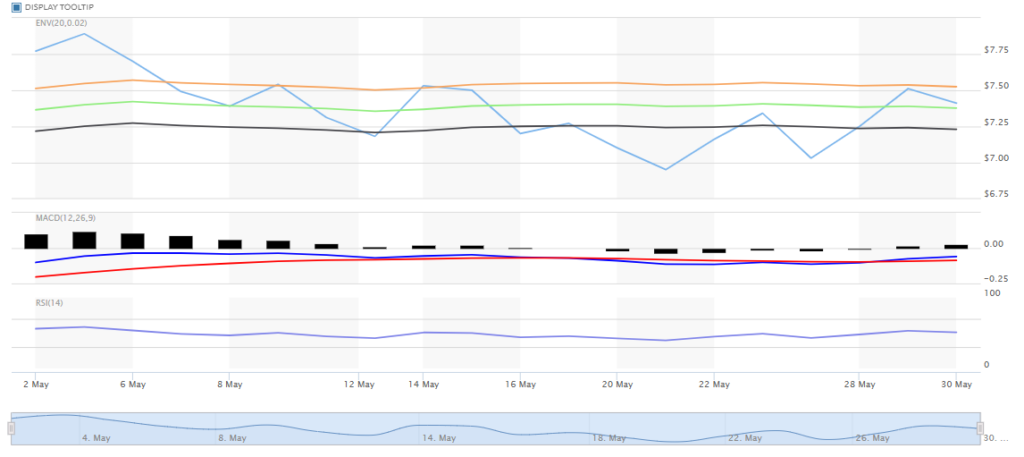

First off, let’s talk technicals. Aura’s stock has been showing some robust signals that make it a tantalizing target for those of us who like to ride the waves of the market. With a strong near-term trading potential and a support level buying signalaround $6.78, the charts are whispering sweet nothings to those with a keen eye for opportunity.

The Analysts’ Applause

But it’s not just the charts that are singing Aura’s praises. The analysts are giving it a standing ovation too! With a consensus that’s leaning towards “Buy,” it’s like getting a nod from the critics at an award show. And let’s be honest, who doesn’t love a good critical acclaim?

A Financial Foundation

Now, let’s dig a little deeper and talk fundamentals. Aura’s got a cash runway of about 3.5 years as of December 2023, which means they’ve got the financial stamina to go the distance. And while their cash burn has increased, it’s still a manageable 17% of their market value. That’s like having a car with a full tank of gas and only a short trip ahead – plenty of fuel to get where they need to go.

Institutional Interest

Institutional investors are holding a significant 50% stake in Aura, which is like having the big players in your corner rooting for you. And let’s not forget the insiders who own 19% of the company. When the folks who know the company best have skin in the game, it’s a good sign that they believe in the journey ahead.

The Aura Advantage

Aura Biosciences isn’t just any biotech company. They’re on the frontier of developing precision immunotherapies for solid tumors. Their lead candidate, bel-sar, is in late-stage clinical development for treating patients with primary choroidal melanoma. That’s a fancy way of saying they’re working on some potentially groundbreaking treatments that could make a real difference in the world of oncology.

A Strategic Stance

Aura’s strategic moves have been nothing short of impressive. They’ve recently announced the acquisition of the Pé Quente and Pezão Projects, which could add significant mineral resources and reserves to the company. This kind of forward-thinking shows a company that’s not just resting on its laurels but actively seeking out new opportunities for growth.

The Market’s Mood

The market has been giving Aura some love lately, with the stock price increasing by 18% last week after a year of 25% losses. It’s like the market is finally waking up to Aura’s potential after a long slumber. And as we all know, once the market gets a taste of what a company has to offer, things can really start to heat up.

A Friendly Forecast

Looking ahead, Aura’s future seems as bright as its name suggests. With a cash burn that’s considered manageable and the potential to raise more cash for growth without much trouble, the company is well-positioned to capitalize on its developments. And let’s not forget the strong near-term trading potential that’s got technical traders buzzing.

The Bottom Line

So, dear investors, if you’re looking for a stock that’s got the technicals, the fundamentals, and the analyst backing to be a potentially profitable play, Aura might just be the stock for you. With a solid financial foundation, institutional interest, and a strategic stance that’s poised for growth, Aura is shining bright in the market right now.

Remember, investing always comes with its risks, but for those who aren’t afraid to embrace a bit of uncertainty, Aura offers an intriguing opportunity. Keep your eyes on the prize, and who knows, Aura might just add a little sparkle to your portfolio. Happy trading!