Hello, dear readers! Today, we’re diving into the electrifying world of digital assets, focusing on a company that’s been generating quite the buzz—TeraWulf Inc. (NASDAQ: WULF). If you’re on the hunt for a potential gem in your investment portfolio, WULF might just be the treasure you’re looking for. Let’s explore why this company is turning heads and why it could be a good buy right now.

A Company with a Vision

TeraWulf is not your average digital asset company. Founded in 2021 and headquartered in the charming town of Easton, Maryland, TeraWulf is on a mission to develop and operate environmentally sustainable bitcoin mining facilities. Yes, you read that right—environmentally sustainable. In a world increasingly concerned with green energy, TeraWulf’s commitment to eco-friendly operations sets it apart from the crowd.

Analysts Are Giving the Thumbs Up

When the experts start talking, it’s wise to listen. Analysts have been quite vocal about WULF, and the tune is predominantly positive. With substantial upgrades to revenue and earnings per share (EPS) forecasts for the next year, it’s clear that the financial gurus see a bright future for TeraWulf. The consensus price target has been bumped up to a cheerful $3.70, signaling confidence in the stock’s upward trajectory.

Financials on the Rise

Let’s talk numbers, shall we? TeraWulf’s financial performance has been nothing short of impressive. The company reported a significant revenue increase of 361% from FY 2022 to FY 2023. What’s more, the net loss narrowed by 14%, showing a clear path of improvement. Analysts are predicting that TeraWulf will hit breakeven in 2024 with an estimated profit of $23 million. For a company that’s just getting started, these figures are quite promising.

Growth Potential That’s Hard to Ignore

The potential for growth is a key factor in any investment decision, and TeraWulf doesn’t disappoint. Analysts expect an average annual growth rate of 133% for the company. That’s not just growth; that’s exponential growth. With the company moving towards profitability and reducing estimated losses for the next year, it’s an exciting time to consider jumping on board.

A High-Risk, High-Reward Scenario

Now, let’s address the elephant in the room—risk. TeraWulf does have a high level of debt, which is a consideration for any investor. However, for those of you who don’t shy away from risk, this could be an opportunity to seize. High debt can lead to high rewards if managed correctly, and TeraWulf has been proactive in reducing its debt, repaying $40 million in the last four months alone.

Market Sentiment and Stock Performance

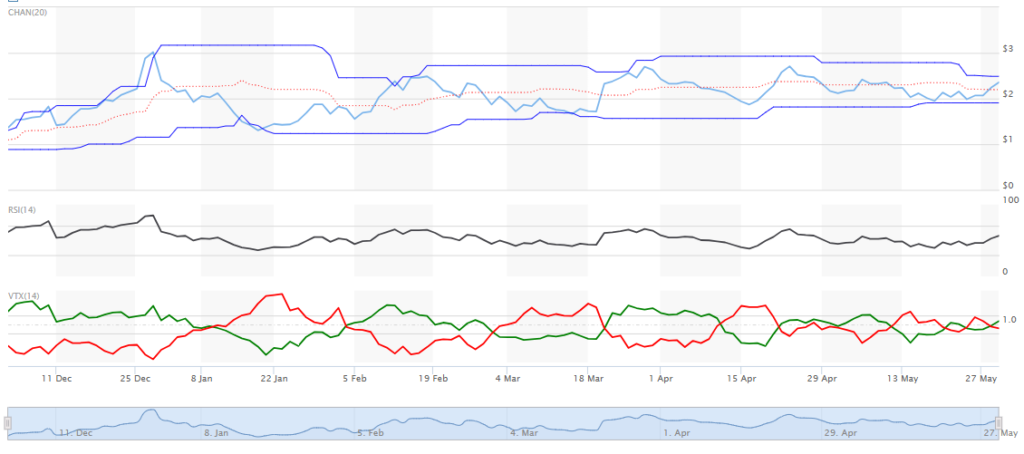

The market seems to be catching on to TeraWulf’s potential. The stock has seen a 21.18% increase over the past month, and pre-market trading has been robust. With a “Buy” consensus from analysts and several setting price targets above the current market price, it’s clear that the sentiment is bullish.

Why Now Could Be the Time to Buy

So, why consider buying WULF right now? The company is on the cusp of profitability, it’s committed to sustainable practices, and it’s backed by a positive outlook from analysts. TeraWulf’s proactive approach to debt reduction and its impressive growth potential make it a standout choice for those willing to embrace a bit of risk for the possibility of substantial rewards.

Final Thoughts

In the dynamic landscape of digital assets, TeraWulf Inc. shines as a company with both vision and potential. While no investment is without risk, the upside of WULF is hard to ignore. As always, do your due diligence, but keep an eye on TeraWulf—it might just be the spark your portfolio needs.

Remember, investing is a journey, and every journey needs a dash of adventure. Happy investing, and may your portfolio glow with potential!