Hey there, savvy investors and tech aficionados! Today, we’re diving into the digital world of Microsoft Corporation (NASDAQ: MSFT), a tech behemoth that’s been a cornerstone of the industry since floppy disks were all the rage. Let’s explore why MSFT might just be the shining star you want to add to your investment portfolio.

A Tech Titan’s Trajectory

First off, let’s talk trajectory. MSFT’s stock price has been on a journey worthy of a bestselling novel, complete with twists, turns, and a cast of innovative products. Recently, the stock has been showing some pep in its step, and if you’re all about growth, MSFT is strutting its stuff like a peacock in spring.

The Technical Tea

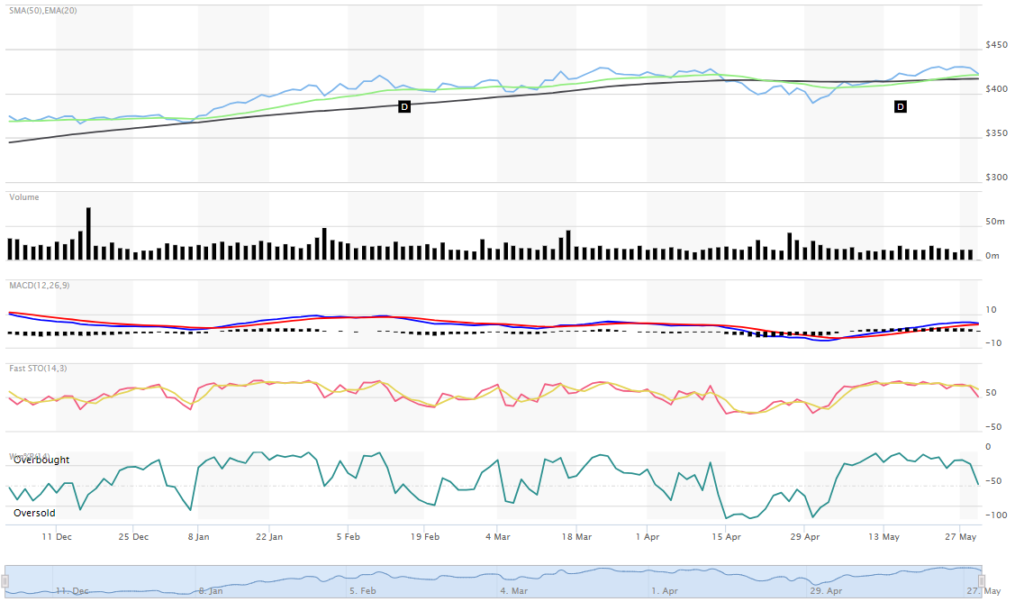

For my chart-loving friends, MSFT’s technical indicators are serving up a fresh pot of bullish brew. The MACD is flashing a grin wider than a Cheshire cat, suggesting that momentum might be swinging in a positive direction. And the RSI? It’s sitting pretty in a sweet spot that whispers, “I’m not too hot, not too cold, but just right.”

Fundamentally Fabulous

On the fundamental front, MSFT is like that friend who’s good at everything without even trying. Their earnings? As robust as a double-shot espresso. Revenue growth? It’s like watching a beanstalk shoot up after Jack tossed those magic beans. And let’s not forget the dividend yield – it’s the cherry on top of an already delectable sundae.

Innovation Is the Name of the Game

Innovation is MSFT’s middle name. From cloud computing to AI, they’re not just keeping up with the Joneses; they’re hosting the block party. Azure, their cloud platform, is soaring through the stratosphere, and with AI becoming the talk of the town, MSFT is leading the parade with tools and services that are as cutting-edge as they come.

A Financial Fortress

MSFT’s balance sheet is stronger than a superhero’s. With a war chest of cash reserves and a debt-to-equity ratio that would make even the most conservative investor swoon, MSFT is built like a financial fortress. In a world full of economic uncertainty, that’s a comforting thought.

The Analyst Applause

The analyst community is giving MSFT rounds of applause, with ratings that range from “Buy” to “You’d be crazy not to consider it.” With a forward-thinking CEO at the helm and a track record of making shareholders smile, MSFT is getting love letters from Wall Street left and right.

A Culture of Adaptation

One of MSFT’s superpowers is its ability to adapt faster than a chameleon on a rainbow. Whether it’s pivoting to remote work solutions or diving into the metaverse, MSFT is always on the move, ensuring it stays relevant and revolutionary.

The Dividend Delight

For those who adore a steady stream of income, MSFT’s dividend is like a cozy blanket on a chilly evening. It’s reliable, comforting, and just keeps getting better with time. And with a payout ratio that suggests sustainability, you can sleep soundly knowing those dividends are here to stay.

A Global Giant with a Local Touch

MSFT may be a global giant, but it has a knack for making every user feel like they’re getting the personal touch. With products that span the globe yet cater to individual needs, MSFT has woven itself into the fabric of everyday life.

The Final Word

In conclusion, dear readers, MSFT is showing all the signs of a buy that could make your portfolio do a happy dance. With strong fundamentals, a commitment to innovation, and a stock price that’s humming a tune of potential, MSFT is a beacon of opportunity in the tech sector.

So, whether you’re a seasoned investor or just dipping your toes into the market waters, keep your eyes on MSFT. It’s a company that’s not just surviving the tech race; it’s setting the pace.

And there you have it, folks – a friendly nudge towards considering MSFT as your next smart buy. Happy investing, and may your portfolios flourish!