Ah, the quest for the golden stock! Today, let’s chat about a healthcare behemoth, HCA Healthcare (NYSE: HCA), and why it’s a tantalizing ‘Buy’ for the short-term trader with a fondness for fundamentals and a taste for risk.

A Healthy Pulse on the Market

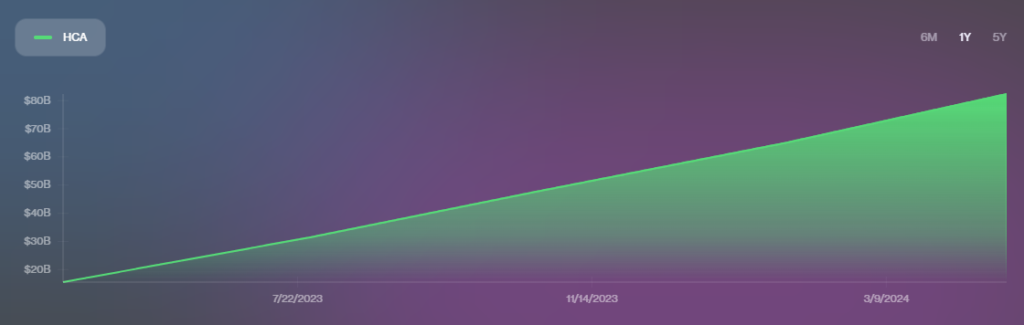

First, let’s check the vitals. HCA’s stock performance over the last year shows resilience in a volatile market. The company’s share price has weathered the storm better than many, and that’s no small feat. Refer to the visual provided for a glimpse at HCA’s stock performance over the last year. It’s like watching a seasoned captain steering a ship through choppy waters – there’s an art to maintaining course, and HCA seems to have mastered it.

The Fundamentals Are Strong With This One

Now, let’s talk fundamentals. HCA’s revenue growth chart is a thing of beauty. The last few quarters have seen a steady climb, as shown in the second visual provided. Revenue growth is a sign of a company’s health and its ability to expand. For HCA, it’s not just about expansion; it’s about smart, strategic growth that translates into shareholder value.

A Prescription for Profit

HCA’s earnings per share (EPS) of $5.93 are a testament to its profitability. In the world of healthcare, where margins can be as thin as surgical gloves, HCA stands out with a robust P/E ratio of 14.59. This indicates that the stock is reasonably priced relative to its earnings. For the short-term trader, this is a green light – it suggests that HCA is not overvalued, and there’s potential for a healthy return.

The Heartbeat of America’s Healthcare

HCA operates a vast network of hospitals and ambulatory sites across the U.S. and the U.K. This isn’t just about quantity; it’s about quality. HCA has been instrumental in clinical studies that have directly improved patient care. For investors, this means you’re not just buying into a company; you’re investing in a leader in healthcare innovation.

A Financial Fortress

Let’s not forget the financials. HCA’s market cap of $84.28 billion is a fortress in the healthcare sector. With a gross profit of $2.56 billion and net income of $1.59 billion, HCA isn’t just surviving; it’s thriving. And with a dividend yield of 0.79%, it’s giving back to its shareholders too.

The Prognosis: Growth

For the forward-looking trader, HCA’s growth prospects are as promising as a new breakthrough in medicine. Analysts have projected earnings growth, and HCA has a history of positive earnings surprises. What does this mean for you? It means HCA is not just keeping pace; it’s setting the pace.

A Culture of Care

HCA’s commitment to patient care extends beyond the hospital walls. It’s about a culture that values every patient encounter as an opportunity to learn and improve. This culture has earned HCA a place as a learning health system, with over 43 million patient encounters annually. For investors, this translates into a company that’s constantly evolving and improving – a key ingredient for long-term success.

Navigating Regulatory Waters

No discussion of healthcare stocks would be complete without a nod to regulation. HCA has navigated these waters with the skill of a seasoned sailor. Despite regulatory inspections and compliance issues, HCA has taken corrective actions and maintained its Medicare funding – a sign of a company that’s proactive and responsive.

The Verdict

In the court of investment opinion, HCA stands accused of being a solid buy – and the evidence is compelling. With strong fundamentals, a commitment to growth and innovation, and a culture that prioritizes patient care, HCA is a stock that promises not just a healthy return but a stake in the future of healthcare.

So, there you have it, my fellow traders. HCA Healthcare is a stock with a strong heartbeat, and for those who like to play the market with an eye on the fundamentals, it’s a buy that could be just what the doctor ordered. Happy trading!