In the dynamic dance of the stock market, Stryker Corporation (SYK) is currently moving to a rhythm that beckons the agile investor. Let’s waltz through the reasons why SYK is a compelling buy at this juncture.

Innovation as a Cornerstone

Stryker’s commitment to innovation is the melody that underpins its market position. With a portfolio that spans MedSurg, Neurotechnology, Orthopaedics, and Spine, SYK is not just a participant but a choreographer in the medical technology industry. The company’s Mako robotic arm-assisted surgery platform is a crescendo in this symphony of innovation, driving demand and setting the stage for future growth.

Financial Harmony

A glance at the financial sheet of SYK plays a harmonious tune. The company reported a robust $5.24 billion in revenue, outperforming expectations. With an earnings per share (EPS) of $2.50 for the quarter, SYK beat estimates, showcasing its ability to translate innovation into financial results. Moreover, analysts are striking a high note with an EPS forecast of 11.95 for the current year.

Technical Indicators in Tune

For the short-term trader, technical indicators are the rhythm section. SYK’s current technical analysis suggests a potential upside. The stock is recommended as a buy near $315.58, with an upside target of $341.32. The support levels are strong, and the resistance levels are within reach, indicating a potential for a profitable trade.

Analyst Ratings: A Chorus of Approval

The analyst community is singing in unison, with a “Moderate Buy” consensus and an average target price of $370.50. Citigroup has raised its baton, setting a target price of $406.00 and maintaining a “buy” rating. Such endorsements from the financial maestros add a layer of confidence for investors considering SYK.

Dividend Yield: A Steady Beat

While SYK’s dividend yield of 0.95% may not be the loudest in the orchestra, it’s a steady beat that adds to the stock’s attractiveness. The company’s commitment to returning value to shareholders through dividends is a testament to its financial health and stability.

Market Performance: Leading the Dance

SYK has outperformed its industry, with a year-to-date rise of 16.3%, while the industry faced a decline. This performance is a testament to the company’s leadership and strategic moves in the market.

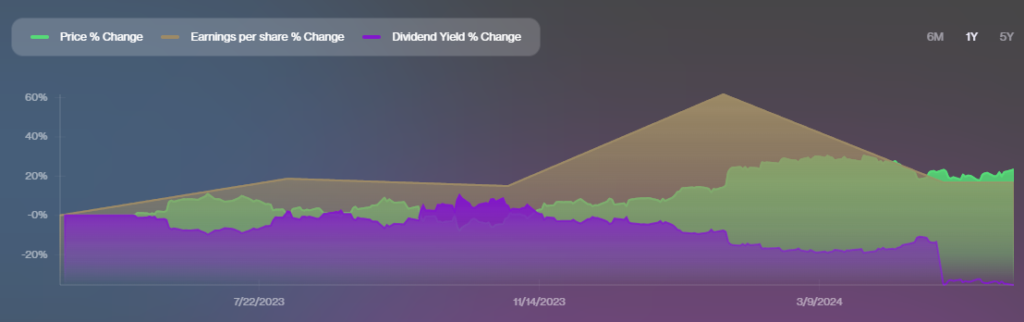

The Graph That Tells the Story

Refer to the visual provided, showcasing SYK’s investment potential chart. The graph illustrates the stock’s price movement, support and resistance levels, and the potential trajectory based on current analysis. It’s a visual representation of why SYK is a buy – the stock is poised for an upward trend, with technical indicators supporting a bullish outlook.

Challenges: The Crescendo Before the Resolution

No composition is without its crescendo, and for SYK, the challenges include unfavorable currency rate fluctuations and inflationary pressures. However, the company’s cost-cutting initiatives and margin improvement strategies are the resolving chords that investors hope will lead to a harmonious conclusion.

Conclusion: A Finale Worth Investing In

In conclusion, Stryker Corporation (SYK) presents a compelling case for investment. With a strong foundation in innovation, positive financial results, favorable analyst ratings, and technical indicators that suggest an upside, SYK is a stock that’s ready for the spotlight. While the market may ebb and flow, SYK’s current position suggests that now is the time to take the floor and consider adding this stock to your portfolio.

For the active trader who likes fundamentals and is not averse to risk, SYK offers a blend of stability and potential growth. It’s a buy that harmonizes the short-term trading strategy with long-term value creation, making it a noteworthy addition to an agile investor’s dance card.