Advanced Micro Devices (AMD) has been a fascinating spectacle in the semiconductor arena, showcasing resilience and innovation. For the active trader with a penchant for fundamentals and a taste for risk, AMD presents a compelling buy. Let’s delve into the reasons why AMD is revving up for a potential rally, supported by two insightful graphs that illustrate its performance and growth trajectory.

Innovation Fuels Growth

AMD’s relentless pursuit of innovation has positioned it as a formidable competitor to industry giants. The company’s strategic focus on high-performance computing, graphics, and visualization technologies has paid dividends, as evidenced by its robust product pipeline and market share gains in the server CPU market.

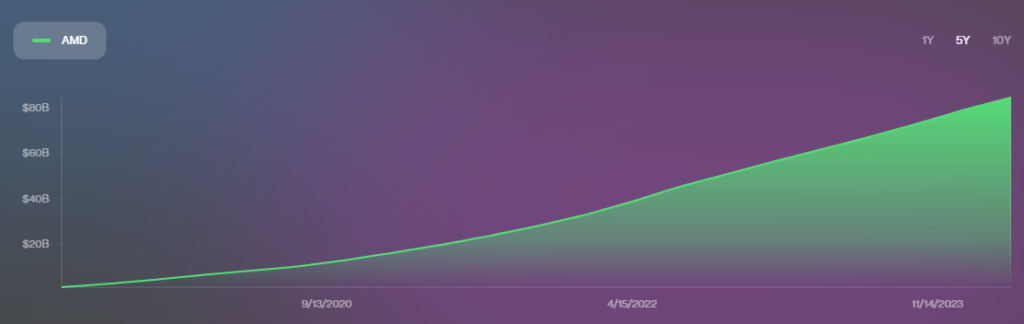

Financial Resilience

Despite market volatility, AMD has demonstrated financial resilience. The company’s revenue growth, as depicted in our first graph, underscores its ability to capitalize on demand for its cutting-edge processors and GPUs. This growth trajectory is not just a blip but a testament to AMD’s deep-rooted strategic execution.

AMD’s Revenue Growth Over the Past 5 Years

Strategic Partnerships

AMD’s expansion of its partnership with Samsung to develop 3-nanometer chip processing technology is a strategic masterstroke. This collaboration is set to enhance AMD’s competitive edge and market share, further bolstering its position in the semiconductor industry.

Market Share Ascension

With a 33% share in the server CPU market and the upcoming launch of “Turin” processors, AMD is poised for further ascension. Its strategic moves have not gone unnoticed, as reflected in the stock’s performance over the past year, which our second graph eloquently displays.

AMD’s Stock Price Performance Over the Past Year

Analysts’ Confidence

Wall Street’s confidence in AMD is palpable, with a consensus “Moderate Buy” rating and a favorable price target. Analysts are bullish on AMD’s market prospects, underpinned by its innovative AI chip developments and strategic partnerships.

Risk-Reward Balance

For the short-term trader, AMD’s stock offers a tantalizing risk-reward balance. Its recent pullback presents a potential entry point, with the anticipation of a rebound driven by its strong fundamentals and market position.

Final Verdict: Buy

In conclusion, AMD’s blend of innovation, strategic partnerships, and market share growth makes it a buy for the active, risk-tolerant trader. While the semiconductor industry is known for its cycles, AMD’s trajectory suggests a company on the rise, ready to capitalize on the insatiable demand for computing power.

As with any investment, it’s crucial to monitor market conditions and company performance closely. However, for those who thrive on the market’s dynamism and have the fortitude for its ebbs and flows, AMD is a stock that promises to keep the adrenaline pumping.