In the bustling digital bazaars of Latin America, one name stands out: MercadoLibre (NASDAQ: MELI). Often hailed as the Amazon of the South, MercadoLibre has carved out a niche that resonates with both consumers and investors alike. Here’s why savvy traders should consider adding MELI to their portfolios.

A Robust E-Commerce Ecosystem

MercadoLibre isn’t just an e-commerce platform; it’s a comprehensive ecosystem encompassing Mercado Pago, its payment solution, and Mercado Envios, its logistics service. This integrated approach has fueled remarkable growth, with the company consistently posting double-digit revenue increases. The first graph, illustrating MELI’s Earnings Growth Over Time, showcases a trajectory that would make any investor’s heart race. The steep upward trend is a testament to the company’s expanding footprint and its ability to capitalize on the burgeoning e-commerce market in Latin America.

Fintech as a Growth Catalyst

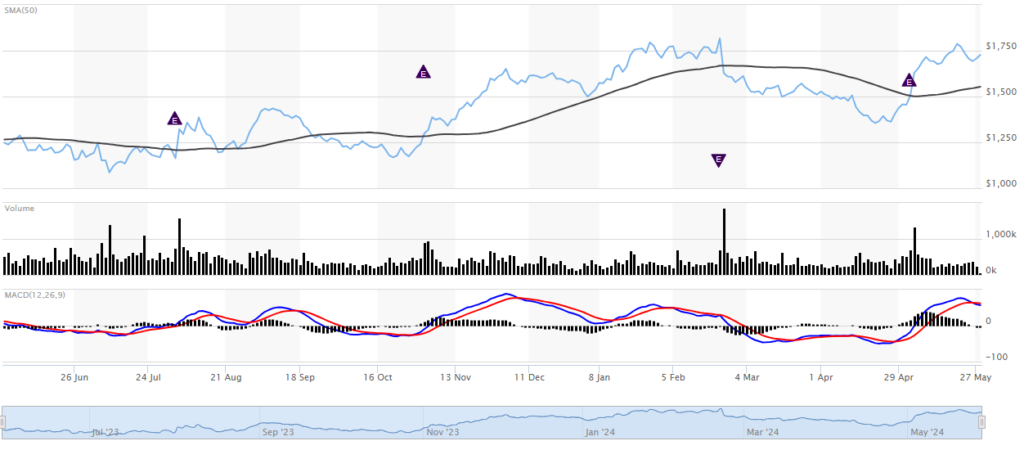

Mercado Pago, the fintech arm of MercadoLibre, has been a game-changer. It’s not just facilitating transactions on the platform; it’s becoming a financial hub for users across the region. With services ranging from payment processing to credit solutions, Mercado Pago is tapping into a market ripe for disruption. The second graph, depicting MELI Stock Price Trend with Technical Indicators, indicates a strong correlation between the company’s fintech ventures and its stock performance. The technical indicators suggest that despite market fluctuations, MELI’s fundamentals remain robust, underpinned by its fintech growth.

Expanding Logistics Network

MercadoLibre’s investment in logistics has paid dividends, quite literally. By ensuring faster delivery times and improving customer satisfaction, Mercado Envios has become a critical component of the company’s success. As the logistics network expands, MercadoLibre is set to capture an even larger share of the e-commerce pie.

Market Dominance and Expansion

MercadoLibre isn’t resting on its laurels. It’s aggressively expanding into new markets and categories, further entrenching its dominance. With a first-mover advantage in many of its markets, MELI is well-positioned to fend off competitors, both local and international.

Financial Health and Valuation

A glance at MercadoLibre’s balance sheet reveals a company in good financial health. With a net cash position, MELI can manage its debt effectively while continuing to invest in growth opportunities. Moreover, the company’s valuation, while rich by traditional metrics, is justified by its high growth rates and the vast untapped potential of the Latin American market.

Analyst Sentiment and Future Prospects

Analysts are bullish on MELI, and for good reason. The consensus price target offers a significant upside, reflecting confidence in the company’s direction. With a track record of exceeding earnings expectations and a clear strategy for the future, MercadoLibre is a compelling buy for those looking to tap into Latin America’s e-commerce explosion.

Conclusion

In conclusion, MercadoLibre stands as a beacon of innovation and growth in the Latin American e-commerce landscape. Its integrated ecosystem, fintech expansion, logistics prowess, and strategic market positioning make it a standout investment. While no investment is without risk, MELI’s fundamentals, growth trajectory, and market opportunities present a persuasive case for buying into this e-commerce titan.

Please refer to the provided visuals for a deeper dive into MELI’s earnings growth and stock price trends.